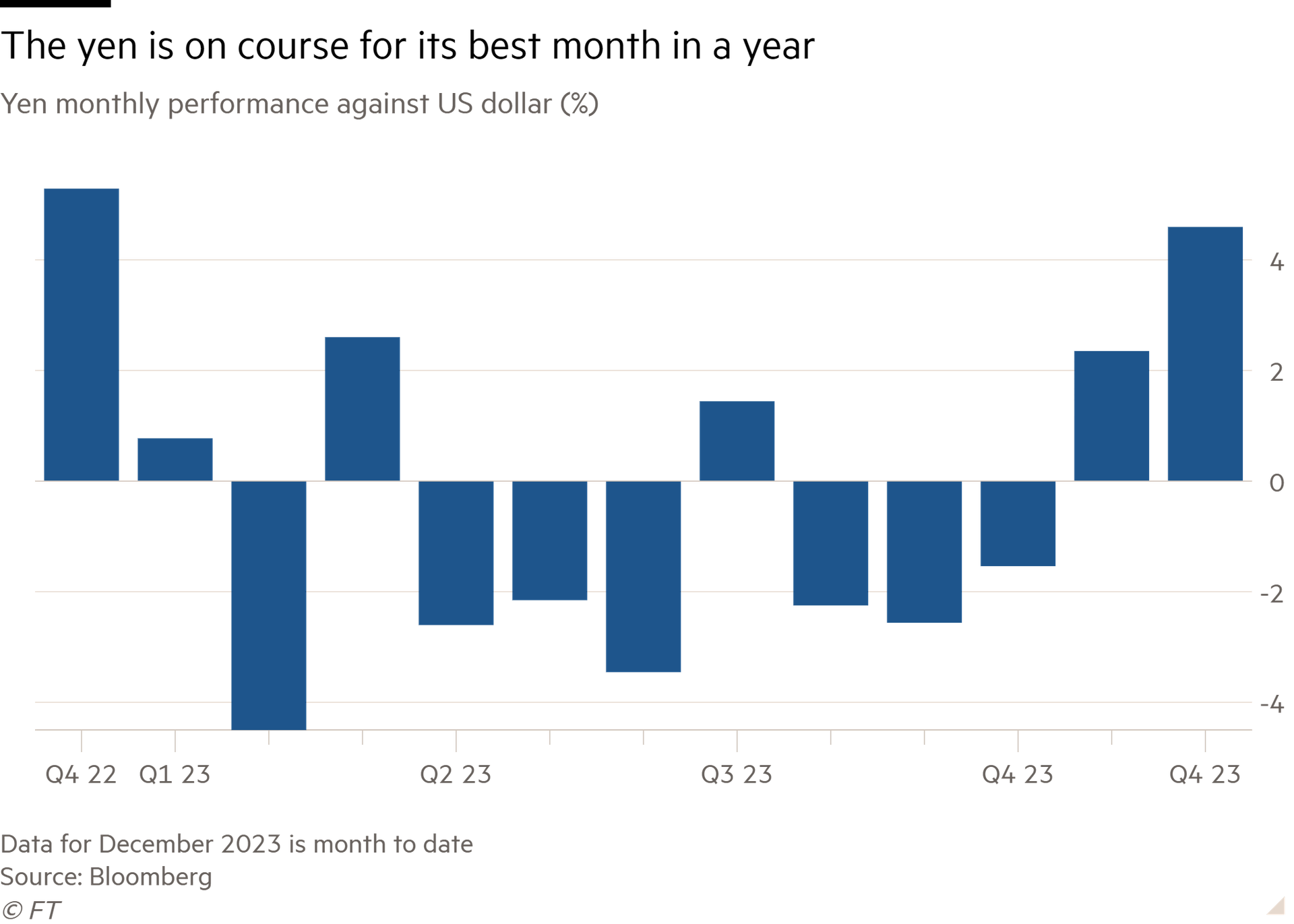

Japan’s currency has run up its biggest monthly gain against the dollar this year, reflecting growing expectations that the Bank of Japan will be forced to tighten monetary policy just as the US Federal Reserve is signalling rate cuts.

The yen has climbed 7 per cent against the dollar since the middle of November to trade at ¥141.59, its strongest level since July, including a 4.4 per cent rise this month.

“It’s been a big move by any standard,” said Chris Turner, head of global markets at ING. “It started with the whole turn in the dollar when the market was turning more dovish on the Fed and then there were stories suggesting the Bank of Japan was ready to lift interest rates.”

The move has helped ease the pressure from rising import prices, which have driven up living costs for consumers this year, but is a headwind for Japanese exporters.

The yen was turbocharged this week after the Federal Reserve surprised markets by signalling it would cut interest rates next year. BoJ governor Kazuo Ueda met Japanese Prime Minister Fumio Kishida last week and told the country’s parliament that managing monetary policy “will become even more challenging from the year-end and heading into next year”.

However, the BoJ is widely expected to keep interest rates at minus 0.1 per cent next week at its final monetary policy meeting of the year. Traders in swaps markets are betting that the bank will scrap its negative interest rate in April or June next year.

“There is ample evidence now that inflation pressures are embedding in the Japanese economy and that Japan’s negative interest rate policy is inconsistent with the economic reality,” said Salman Ahmed, global head of macro at Fidelity International.

The rapid decline of US bond yields eases the upward pressure on Japanese yields as the BoJ gradually unwinds its unconventional policy of holding down its benchmark borrowing costs. The spread — or gap — between 10-year US and Japanese government bond yields has narrowed to 3.2 percentage points, down from more than 4 percentage points in October.

Michael Metcalfe, head of global market strategy at State Street, custodian to $40tn of assets, said fund managers had been adding to their yen positions over the past fortnight on speculation that the BoJ will soon tighten policy.

“The yen offers an attractive combination of valuation and the possibility of monetary policy becoming more, not less, supportive,” Metcalfe said, adding that the dollar was 40 per cent overvalued compared with the yen based on measures of purchasing power parity.

Some currency strategists believe the yen will continue to strengthen next year, with the gap between US and Japanese interest rates expected to narrow. Many investors have been using the yen to fund so-called carry trades whereby they would borrow the yen and lend in dollars.

“The possibility that the Fed could ease policy in 2024 while the Bank of Japan begins to tighten puts the dollar-yen carry trade under pressure,” said Erik Norland, senior economist at CME Group.

“In the past, the yen has been subject to rapid upward moves when carry trades liquidate.”